Addressing the SDA Supply-Demand Imbalance in Regional NSW

The demand for Specialist Disability Accommodation (SDA) in regional New South Wales (NSW) is growing rapidly. However, despite the increasing need, supply remains inadequate or mismatched in many areas. Our analysis of recent data highlights key trends and challenges in SDA provision, particularly in regional NSW, and explores potential solutions to ensure individuals with disabilities have access to the housing they need.

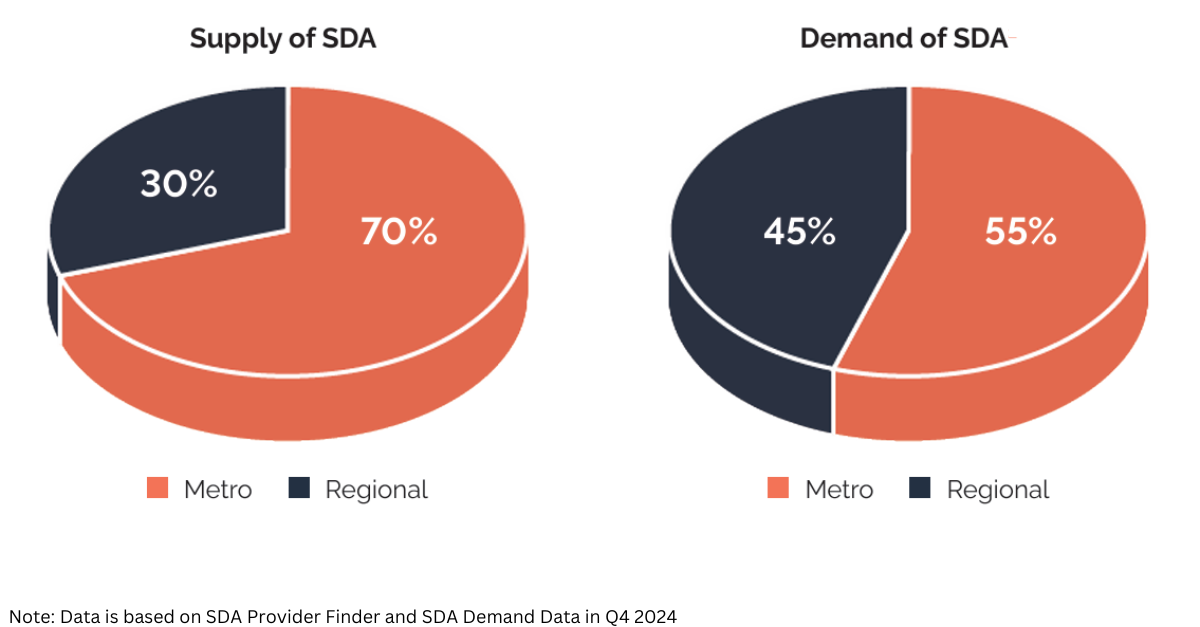

Supply-Demand Mismatch

While demand for SDA is nearly balanced between city and regional areas (46% vs. 54%), supply tells a different story: only 30% of SDA dwellings are in regional NSW, compared to 70% in metro areas. This discrepancy creates both a challenge for participants and an opportunity for investment.

Regional participants understandably prefer to stay close to family, friends, and support networks. However, they often find themselves without suitable housing options, and there’s no clear investment pipeline to bridge this gap. New SDA supply is heavily concentrated in Greater Sydney and other major metro areas, leaving regional demand largely unmet.

This supply-demand mismatch in regional NSW presents a compelling investment opportunity—one that offers strong risk-adjusted returns while delivering much-needed, fit-for-purpose housing to Australians truly in need.

A Krugman-Sized Challenge

To borrow from Krugman, markets aren’t always efficient, and SDA investment in the regions is a classic case of supply not following demand. Several key issues contribute to the imbalance:

1. A Young Asset Class with Cautious Investors

SDA is still a relatively new asset class, having launched in 2016. Initially, investors played it safe, concentrating on metro areas under the logic: “If this doesn’t work out, I still own a well-located property in a major market.” Now, with the scheme maturing and proving its resilience through multiple changes in government, investors can confidently look to regional areas where the imbalance is most pronounced.

2. The Early Incentives Favoured Metro Markets

When the SDA framework was first introduced, the highest rental returns were for High Physical Support (HPS) apartments. Since apartments are the quickest way to scale a portfolio, many investors opted for metro-based developments. However, in regional areas, houses and villas are far more desirable than apartments, making portfolio scaling slower.

Over time, metro areas saw an oversupply of HPS apartments while regional areas remained undersupplied. The 2023 five-year SDA pricing review adjusted incentives to encourage more investment in regional housing, but so far, the impact has been limited. Why? That brings us to our next point.

3. Metro Mentality & Tax Settings (Okay, Mostly the Tax Settings)

Investors from metro areas have long been reluctant to venture into regional property markets. A big reason for this? Australia’s tax system, which overwhelmingly rewards capital growth over cash flow. Capital appreciation is faster in cities, and as Charlie Munger famously said, “Show me the incentive, and I’ll show you the result.”

But SDA flips this model on its head. Unlike traditional residential real estate in Australia, which relies on capital growth, SDA’s value is driven by strong positive cash flow and derives value from a commercial style cap rate, rather than speculation. This makes it a unique and compelling asset class—if investors are willing to break free from traditional metro-centric thinking.

Bridging the Gap: Brookline Property Group

Having worked in U.S. real estate funds focused on submarkets like multi-family, student and affordable housing, I’ve seen firsthand what institutional-grade investment in residential property can achieve—for communities, investors, and overall housing supply.

Taking a data-driven approach (and leaving my metro bias at the door), we see the following:

SDA is an emerging asset class with economic dynamics similar to the U.S. affordable housing sector.

The greatest supply-demand imbalance is in regional areas, and SDA’s pricing framework now favors regional investment.

(Note: At this stage, BPG is focused on regional NSW rather than other states. We can ditch the metro mindset, but we’re keeping the NSW mindset!)

Too Big for Some, Too Small for Others

Regional NSW presents a scale paradox: it’s too vast for small investors to gain meaningful market penetration, yet too fragmented for institutional funds to deploy capital efficiently. Large funds managing billions of dollars can’t justify writing individual $1.5M–$2M checks—but they can invest in a portfolio of 100–200 properties.

That’s where we see our opportunity: building a regional NSW SDA portfolio that sits in the sweet spot—too large for individual investors to scale, but too specialized for big institutions to execute efficiently.

By doing so, we’re investing in critically needed housing for Australians with extreme functional impairments and very high support needs—while also delivering superior risk-adjusted returns for our investors.

Final Thoughts

SDA investment in regional NSW is a rare case where strong social impact aligns with strong financial returns. The need is clear, the data supports it, and the framework is evolving to encourage it. What’s missing? Investors willing to embrace a new mindset—one that sees beyond traditional metro bias and recognizes the compelling opportunity in regional